foreign gift tax reddit

I was born in the UK but I live in the US now as a Green Card holder. So doesnt this create a gift tax loophole.

Got This 113 Year Old Coin As Change When I Went To Buy Some Smokes A Few Days Ago At The Gas Station 1900 Silver Dollar Old Coins Coins Valuable Coins

The TT employee missed the foreign part but this is also a two-year old question.

. Or does this mean I have to report taxes for the financial gift if individual gift exceeds 100k. When IRS Form 3520 Is Due. Heres the contrasting situations where A and B are US residents and C is a foreign national.

My dad passed away 15 years ago and left behind a trust fund in the UK for me and my sister. If the gift is from a foreign estate or a nonresident alien you only need to report the amount if the total amount of gifts is more than 100000 for the tax year. US citizens can gift up to 15000 2020 per person each year.

Citizen or resident alien the gratuitous transfer of the asset must be real legal or implied made by a foreign resident individual estate or trust outside of the geographical limits of the United States while the gifted asset is also located outside its borders. Money given to political organizations is not subject to gift tax. There is a 100000 annual allowance per individual person who is the foreign gift giver before Form 3520 is required.

Applicable credit amounts are available against gift tax and estate tax for US citizens and domiciliaries equivalent to 11400000 of. Does this mean I have to report taxes for the financial gift if total exceeds 100k per year. The recipient of a gift does not have to pay tax period.

There are various thresholds that may require you to report the amount of the gift to the IRS. The annual exclusion of 15000 can further be increased to 30000 if you and your spouse are both US citizens and elect to split the gift. The IRS Reporting of International Gifts is a very important piece in the Offshore Compliance puzzle.

In order for a foreigner to avoid the US. In general a foreign gift or bequest is any amount received from a person other than a US. However is this limit per person or per tax return since we.

A is taxed on the amount above the exclusion 15000 for 2021. Person receives a gift from a foreign person. Form 3520 Foreign TrustGifts.

Even though there are no US. If anyone can help with this or simply point me in the right direction Id be so grateful. If anyone can help with this or simply point me in the right direction Id be so grateful.

Taxpayer from a foreign person. Gift of 30000 from A to B. What is a Foreign Gift.

Foreign gift over 100k in a year from foreign persons need to be declared by the recipient on Form 3520. Typically if a foreigner gifts money or. The TT answer is at least half-right.

If you as a US person receive a gift of more than 100000 from a foreign person you are required to submit a Form 3520 to the IRS. Gifts to foreign citizens are subject to the same rules governing any gift that a US. There is currently 2021 an annual exclusion of 15000 per recipient meaning there are no filing requirements or impact to the givers lifetime exemption on any money up to 15000 per year.

So apparently gifts from foreign nationals arent taxed. The rules are different when the US. We finally received some payments from the.

Note however that amounts paid for qualified tuition or medical payments made on behalf of a US. The IRS ignores gifts under 15k as of 2018 per year per donor per recipient. A foreign gift is money or other property received by a US.

Cash Gift from Parents Overseas. In the US there is a gift tax regime. A foreign gift does not include amounts paid for qualified tuition or medical payments made on behalf of the US.

Tax ramifications on the initial receipt of a gift from a foreign person although usually an IRS Form 3520 is required the lack of reporting of the foreign gift on behalf of the US. Person gives a gift that exceeds the annual exclusion amount they typically must file a Form 709 unless an exception or exclusion applies. To be considered a foreign gift the recipient must elect to treat the property or money as a gift or bequest and exclude the amount from gross income.

This is purely informational is not taxed and does not deplete any allowancesexemptionsexclusions. Foreign gift tax reddit Saturday April 2 2022 Edit. Foreign Gifts and Bequests.

That is because the foreign person non-resident is not subject to US. The rates are the same whether you are a US citizen US domiciliary or non-US domiciliary. The annual exclusion of 15000 can further be increased to 30000 if you and your spouse are both US citizens and elect to split the gift.

The value of the gifts received from foreign corporations or foreign partnerships must exceed 16815 as of tax year 2021. Undisclosed Gifts from a Foreign Person. Gifts given to a spouse are not subject to gift tax.

Making cash gifts to foreign citizens. Gift of 15000 from A to B and also gift of 15000 from A to. IRS Form 3520 - httpwwwirsgovpubirs-pdff3520pdf.

Essentially meaning individuals can gift up to 15000 to multiple recipients without incurring gift tax. Person from a foreign person. Procedural and legal authority for the exchange of information with foreign partners is found primarily within IRM 4601121 Authority - Disclosure Confidentiality and Contacts with Foreign Tax Officials.

I understand the IRS allows cash gifts of up to 100000 from a foreign non-corporation party without needing to report on Form 3520. Person a foreign person that the recipient treats as a gift or bequest and excludes from gross income. If the gifts or bequests exceed 100000 you must separately identify each gift in excess of 5000.

This value is adjusted annually for inflation. Gift tax for gifts made to a US. Estate and gift tax rates currently range from 18 -40.

The giver might owe gift tax but in this case that would be a matter for the parents to deal with in their home country. If a gift exceeds the annual exclusion amount which is. Any Estate and Gift Tax program employee considering any contact or exchange with a foreign tax official must contact EOI for guidance.

There isnt even a form to report them if you wanted to. Once the 100000 threshold has been surpassed the recipient must separately identify each giftinheritance that is more than 5000. Form 3520 is an informational form only.

So A is taxed on 15000. The tax applies to all transfers by gift of property wherever situated by an individual who is a citizen or resident of the United States to the extent the value of the transfers exceeds the amount of the exclusions authorized by section 2503 unified credit against gift tax and the deductions authorized under section 2522 charitable and similar gifts and 2523 gift to. The 100000 limit can be breached in aggregate by the receipt of several smaller gifts made by that same person or by related persons totaling more than 100000 intended for any one United States individual.

A foreign gift is an amount that is received by a US. Foreign Gift Tax the IRS. You do not report a gift received on your personal tax return regardless of the amount received.

Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more than 100000 during the tax year.

Foreign Pensions Expat Tax Professionals

Tax Cuts The Gift That Keeps Not Giving

What Cash App Users Need To Know About New Tax Form Proposals 12newsnow Com

Will The Money I Earned Abroad Be Taxed When I Move Home

Taxing Foreign Corporations In The Digital Age Verni Tax Law

Four Ways To Legally Avoid Paying Us Income Tax

Gig Workers Need To Get Ready For Tax Forms Protocol

Do You Pay Us Taxes On The Sale Of Inherited Foreign Property

Foreign Tax Credit Limitations Rules For U S Expats H R Block

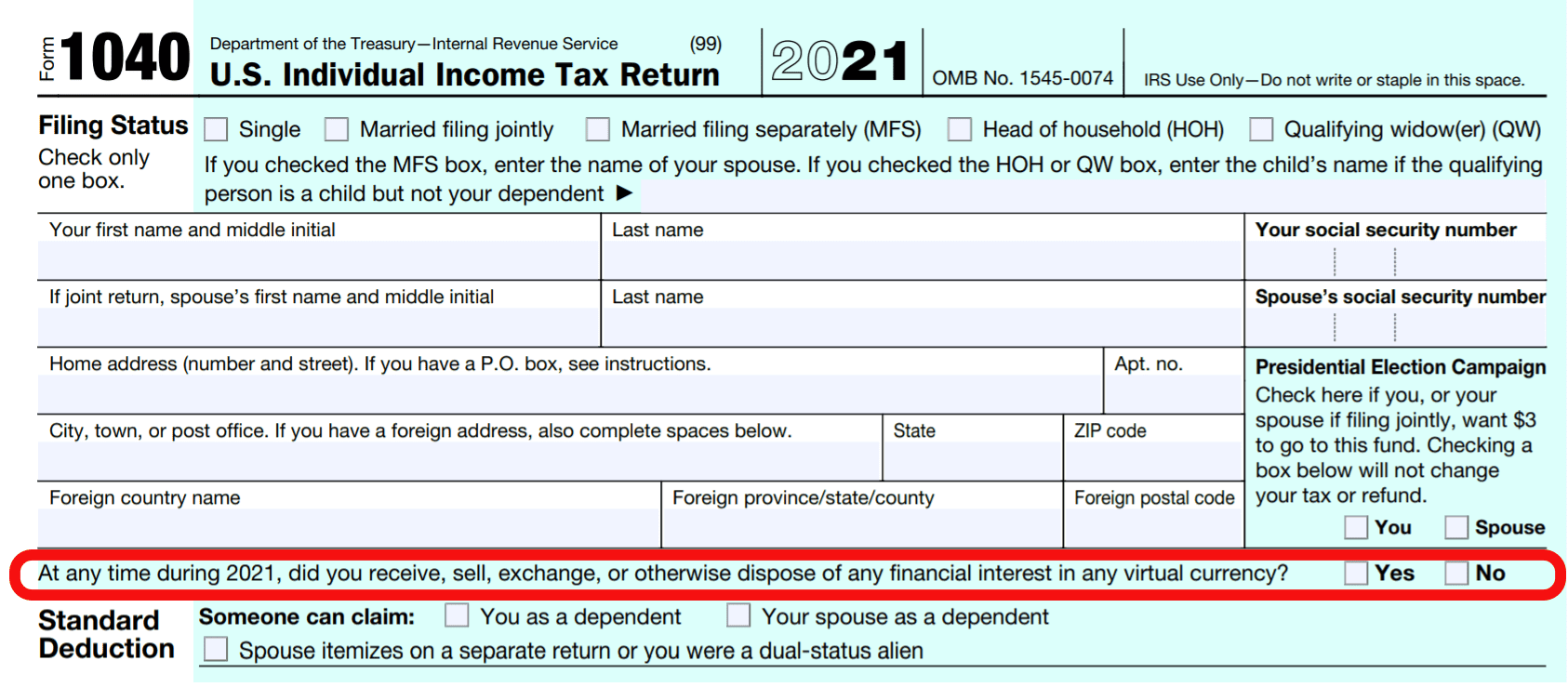

How To Answer The Virtual Currency Question On Your Tax Return

Best Tax Software For 2022 Turbotax H R Block Cash App Taxes Plus Deals And Discounts Cnet

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Htko High Tax Kick Out Summary Explanation With Example

How To Fill Out A Fafsa Without A Tax Return H R Block

Russian Ministry Of Finance To Introduce Changes To Individual Income Tax Laws Russia Briefing News

Non Resident Alien Tax Compliance Avoid The Trap

Tarot 12 Houses Etsy Numerology Horoscope Spiritual Horoscope Astrology Numerology

A Guide To Japan S Amazing Tax Exemption Scheme For Investment By Individuals Tsunagu Local